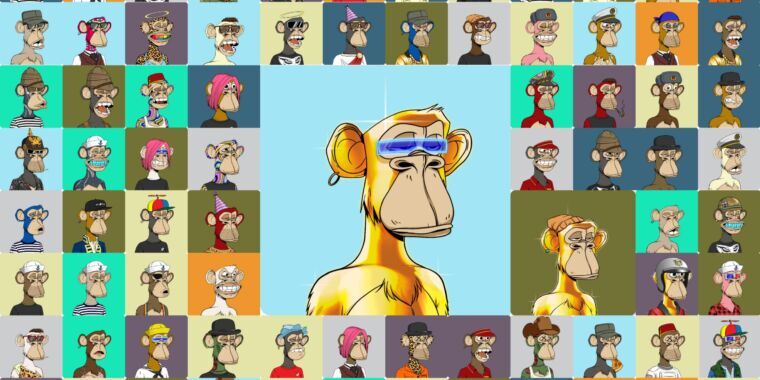

Lawsuit: Sotheby’s $24M sale to FTX gave Bored Ape NFTs “an air of legitimacy.”

My my, whoever could have seen this coming other than 99.9% of the population.

So the idea is that because FTX and Yuga Labs were all mixed up in each other’s business, and because FTX was secretly the buyer of the Bored Apes, then functionally this was a giant wash trade, one step removed. A sham auction whose purpose was to blow up the price of NFTs, and Sotheby is supposed to be culpable because they participated in the sham and lent it legitimacy with their reputation.

That seems like a pretty legit complaint.

I mean, I have no sympathy for the people who got fucked buying NFTs but I have even less sympathy for the people who did the fucking, so absolutely let this lawsuit happen and let them burn.

I think this hinges on whether Sotheby knew FTX was the buyer and intentionally misrepresented that fact, and that sounds likely.

That said:

That’s an average [sale] price of over $241,000, but Bored Ape NFTs now sell for a floor price of about $50,000 worth of ether cryptocrurrency

…

It peaked at over $420,000 in April 2022 but plummeted to about $90,000 six weeks later

I think that’s actually pretty hilarious. So the price started inflated, hype ramped it up to almost double after the auction, then it crashed ~80% over a few weeks, and now it’s almost half that crashed price. Why are they still worth ~$50k?

Screw everyone involved. I hope it’s a long, expensive lawsuit for everyone.

It’s hella malicious, but I sincerely hope this lawsuit gets tossed or these people lose if it goes through.

Those people played the bag holding lottery and lost hard. They were not scammed because they chose to listen to all the shills instead of doing their DD on a financial decision that they knew next to nothing about. If they did, then they would know NFT art and crypto is pretty much all hype with no intrinsic or physical value to actually back those things.

Look up the actual history of Selling Bridges in New York and other places. People spent often their life savings on such financial gambles.

For a moment, I was thinking that it’s easy to criticize NFTs with the benefit of hindsight. After all, throughout history, how many things were looked at as a fad or a waste of money before becoming huge?

Then I remembered that people weren’t just griping about NFTs because they were new and different. Reasonable people had been making rational, educated criticisms of NFTs since day one. None of this was unexpected. NFTs turned out to be exactly the kind of scam that most people thought they were.

Lol. Monkey JPEGs get funged.

Fuck all NFT people right in the earhole, but I think it’s reasonable to nail Sotheby’s to the wall for their part in this charade.

Imagine asking somebody to fart in your face and then getting pissed off that it smelled bad.

@bradboimler Imagine you could sue someone for being dumb. Then we would even have less rich people.

lol

Man sets money on fire, sues store that sold him the lighter

The way a lot of these NFTs fucked themselves over was promising something in addition to the NFT, like a game or whatever, that they never delivered on. If it was always “buy link to monkey pictures” and that’s it they could probably get away with it no problem

Huehuehue

This is some of the most uplifting news I’ve seen today