- 6 Posts

- 4 Comments

5·11 months ago

5·11 months agoInteresting, Still trying to get my head around it…

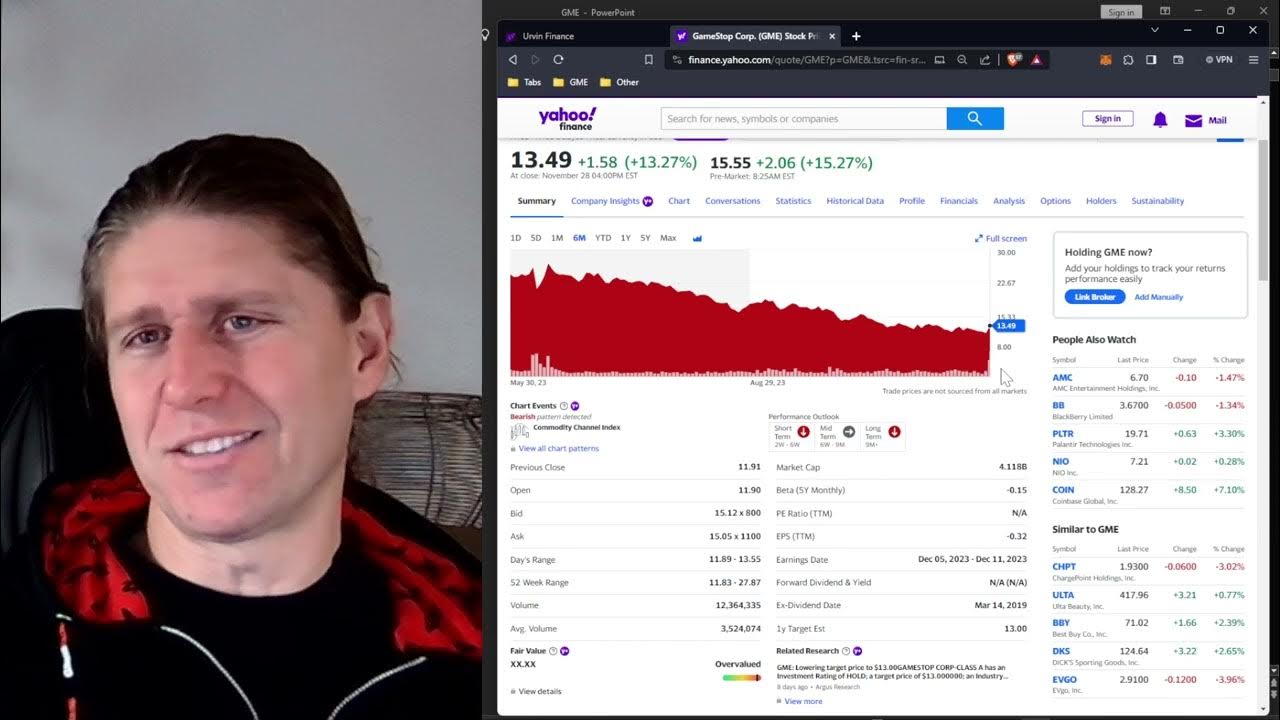

If the 10-K on 3/22/2023 had ~76,000,000 Then the stockholder list on 4/21/2023 had 76,265,982 (did the investors count this themselves?) Then the 10-Q on 6/1/2023 had ~76,600,000

If you look at the stockholder list, which contains book and plan, it seems to correlate well with the 10-Q and 10-K, for which we don’t know what type of shares are included. If the 10-K/10-Q didn’t contain all or a portion of plan, wouldn’t you expect the stockholder list to have higher amounts of shares compared to the 10-Q/!0-K since you know the stockholder list had plan shares whose numbers were confirmed to be accurate?

7·11 months ago

7·11 months agoWhen the investors saw the list of stockholders and then confirmed with peoples that their share numbers were correct, were there any people who had their numbers confirmed that had both book and plan at that time?

If so, were they what they were expected? e.g were both book and plan number correct? Because if they were correct then it makes it more unlikely that there was operational efficiency draining from DRS non-Book shares on certain dates.

42·1 year ago

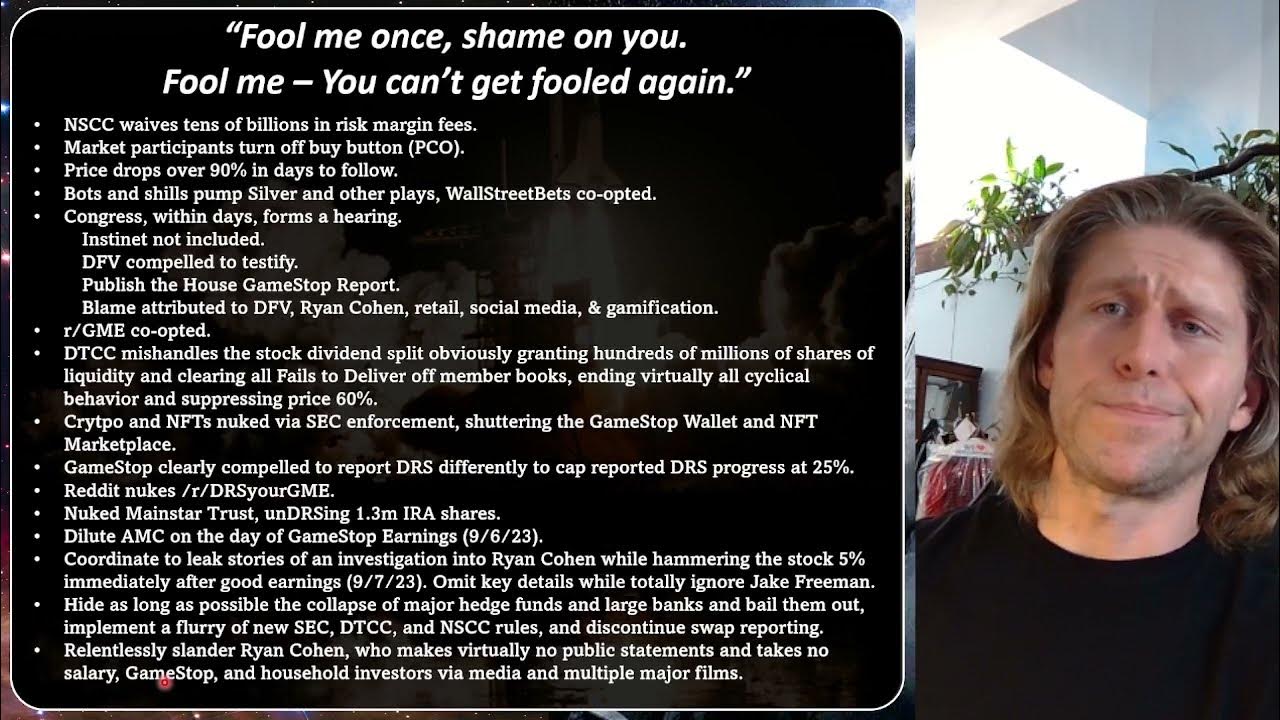

42·1 year agoI think it is a good video to watch, because it is important to be able to articulate your position in the face of criticism rather than avoiding (or banning) any dissenting views.

If someone was watching the video with limited knowledge of the situation, he would come across as reasonable (although a little condescending)

Of course the question is what separates the Gamestop investment from BBBY and AMC, which both seem reasonably certain not to end well and people on the outside would struggle to see the difference between GME and BBBY/AMC.

Even without bringing up naked shorting etc - The lack of debt, ~1billion dollars in cash/equivalents, and a CEO whose vision aligns with investors, with whom 25% are directly registered, seem to be a huge difference.

It is easy to attack retail investors, who don't belong to the rich/ruling class and see this as both get out of their current situation and stick it to the ruling class (its a big club and we aren't in it - https://www.youtube.com/watch?v=Nyvxt1svxso), but maybe his time could have been better looking at the ruling class rather than household investors ? (2.5 hours is a long video!)

It just doesn’t seem right does it that you go from 0 to 70,000,000 in a year, then nothing for the next year, especially the last 3 months when the price has been under $15, which is why we have all these theories and no one trust the number.

But because everything is opaque, no one really knows. If ‘they’ did load up early on DRS counts, how do they know how many to un-DRS to keep it at a constant number, I guess with their algorithms and data from the bi-monthly buys from computer share plus brokers data it could be possible to know how much retail is DRSing.

Actually there must data from bi-monthly buys for the last 3 months, has anyone calculated how many shares have been bought via this mechanism since we know the times when they are bought?