I don’t like avocados. I’ve literally never had avocado toast.

And somehow I’m not a millionaire.

Have you tried getting a 10 million dollar loan from daddy?

Have you considered supplementing your income by committing massive fraud?

You need to start by making small changes to your daily habits, and build up to massive fraud. If you try to do it all at once the habit wont stick.

I dont know about that. Small crimes get prosecuted. Big crimes? You just pay a fine that’s less than what you made.

I’m thinking “big crimes” is probably better overall. Might as well just start there.

Small crimes from small fish. You can only take money from people who have less than you, that’s how the fraud system works. So you gotta ramp up your frauding slowly.

I was attempting to be facetious and mimic the self help type advice you see about daily habits, but yes, if you want to get away with it, bigger is probably better.

How to be a millionare by 30:

- Start a buisness in an untapped market

- get investors

- work all day every day

- workout and meditate to keep you body and mind healthy

- save as much as you can, not starbucks!

- .~get 2 million as a gift from parents~

- sell the buisness once it is valued over a million

- use that money to start a new one

I have seen many adverts rich people make so heres a schedule:

Wake up at 4am

Get dressed 4-5

Go to gym 5-7

Get changed 7-8

Eat breakfast 8-8:30

Read newspaper 8:30-9

Work 9-12

Lunch 12-13

Hit the club 13-17

Dinner 17-18

Club again 18-?

Do these and you will be a billionare in no time. If you are an older gentleman replace the club with golf.

Sell business once it is valued over a million

-invest in GICs/Bonds on a 5 year maturation or high yield savings accounts (~5%)

-Every 5 years collect $275,000 on a $1M principle.

-Now you make average money and you don’t even have a job.

You don’t see the ultra rich getting fancy coffee from your local barista.

They pay assistants to do that for them.

which is honestly fucking sad, you bet your ass i’d be buying the most expensive shit from the local coffee shop if i had a billion dollars

It’s one coffee, Michael, how much can it cost? $100?

Not only does the assistant buy the coffee. He also drinks it, and does all the work for the billionaire.

As it should be. Imagine earning millions of dollars and still having to work for it

I go out for a chai latte sometimes and bring my daughter with me to get a smoothie. Fuck people who think everyone else should cut back on this shit. Just because you’re not wealthy doesn’t mean you don’t deserve the occasional nice treat to make your life a little less dismal.

I don’t know avout deserving, cutting back is just something many do to make ends meet. If you have the money for tea and smoothies then I don’t see what the issue for anyone would be.

You can cut back to make ends meet, which we do, and still get the occasional thing to make your life not shit 100% of the time. Would we do better financially if we didn’t do the occasional thing to make us happy? Sure. Why though?

Spending money doesn’t make me happy. It might be the good coffee or spending time with my friends in a cafe that was the thing making me happy. So for me it’s not a fight about doing things that make me happy vs not. I usually try to find another way to be happy, like buying good coffee to make at home and so on for things I try to cut back from.

Would we do better financially if we didn’t do the occasional thing to make us happy? Sure. Why though?

That’s what I’m wondering too. If you can afford those things and they make you happy, who thinks you don’t deserve them or thinks you shouldn’t do them?

The people who say that you’ll be more financially successful if you don’t buy coffee or have avocado toast or do anything else that might give you pleasure that involves purchasing anything at all.

Also, I’m not sure how you get ‘the good coffee’ without spending money on it. Even if you make it at home, you have to buy the coffee.

The people who say that you’ll be more financially successful if you don’t buy coffee or have avocado toast or do anything else that might give you pleasure that involves purchasing anything at all.

I can’t say I’ve met those people. I guess you could save money that way but of course spending less doesn’t make you earn more or something.

Also, I’m not sure how you get ‘the good coffee’ without spending money on it. Even if you make it at home, you have to buy the coffee.

Saving money isn’t just about spending 0$ on something but spending less…

Here you go- https://www.theguardian.com/lifeandstyle/2017/may/15/australian-millionaire-millennials-avocado-toast-house

And spending less than what?

Australian millionaire

2017

I’m feeling like this is not a very common situation but I guess now I can’t say that I’ve never bumped into that sentiment. Though I think this is the first time for me.

And spending less than what?

Less than you used to…? I think I might’ve misunderstood your question since it sounds like you are asking how saving money by spending less works. And I doubt that’s the case

Important note in small script:

only applicable if you’re a millionaire alreadyOr a friend or relative of a Tory MP.

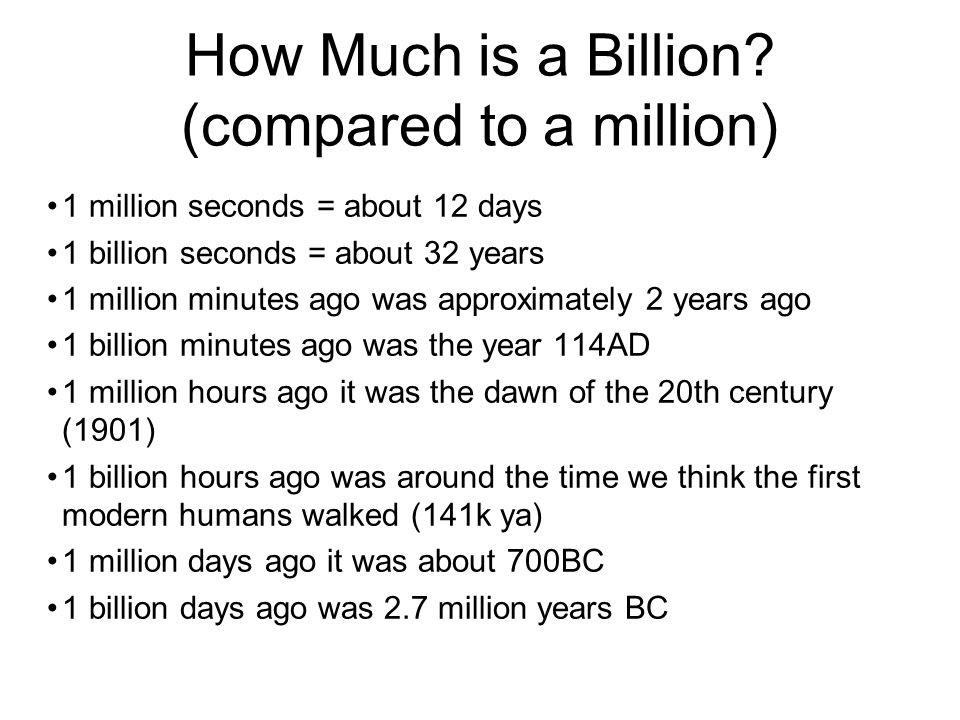

Being a millionaire is just saving a portion of income for 30 years and you can easily hit a net worth of a few million dollars.

Being a billionaire requires some level of absurdly lucky success, fraud, exploitation, and rich parents.

That’s setting aside $33,333/yr

That’s not easy for most people

Have you tried to have your parents buy you a house when you were 18 ? Many people forget to do this simple step. /s

Funny enough I actually did get parental help to buy a house a couple years back. Just a bit extra on our down payment to ensure we got this house rather than 3 more months of hunting for a good deal, but help is help

And even with an expensive Californian house added to my net worth I’m not even halfway to a millionaire and wouldn’t be able to save money to get there like was suggested. A million dollars is a fuck load

Haaa, but you missed out on the most important point, you need your parent to get you a house as soon as you stop living in theirs, that way you never pay rent, by the time you are 30 you would have saved 12 YEARS of rent, so probably enough to invest, create a business, buy houses to rent to other people (or whatever else rich people do to steal money from the workers).

Silly me, they only bought me a mansion. Guess I missed the boat if I’m past 18 now huh?

yes, too late, I’m sorry I should have mansioned it.

I mean, that would be considering there is no interest at all. Yes if you would put it under a mattress, sure. If you would put it in s&p for instance, even on the low end you’d be getting about 6%. At that interest compounded monthly, you’d be able to be a millionaire at about $1000 a month, or $12000 a year. Still a buttload, but not unfeasible for dual earners without children, depending on where you’re located and in what industry of course.

If it takes two people bringing money together to have a million, they are not millionnaires unless they can find another million.

Check the couch.

If you were saving it. Actually you would be investing it so no need to actually save up 1 million. 30 years is on the optimistic side though. The more common problem seem to be low wages, as those leave nothing to be safed (for 30+ years) at the end of the month.

It is between retirement savings and a. Net worth includes a home, that crazy expensive half million dollar house is going to seem cheap 30 years from now and is likely going to be a million dollars on it’s own.

Those are the numbers of you’re not investing your savings. You can use an investment calculator to see what it is if you’re investing it, with an assumption of average returns. Non trivial to get a million dollars in 30 years, but way less than $33k.

Bring able to save a significant portion of your income more than the US poverty line for 30 years without some black swan life event happening to drain it also partly depends on being lucky or/and not having children. The median US household makes plenty to become millionaires for maintainkng a reasonable QoL if there aren’t any such black swan events or children involved.

For my mom, it was a custody battle for children that initially wiped her life savings. She since has often worked 100 hours weeks at a job that pays above average for a blue collar job to make enough to back up to retire (plus happens to have worked at the same company long enough to get a pension, something they phased out for anyone less senior than her), but that’s not something anyone should be expected to do be able to retire, so I’m not quick to judge people for not having accumulated money.

But a lot of people waste money on convenience in ways that definitely add up cumulatively over the decades. $5/day adds up to $150k after adjusting for inflation over 30 years. A $10/month subscription is $10k over 30 years. Reducing costs like that in a few places can cumulatively get you to at least theoretically being on track to be a millionaire.

The QoL aspect is extremely important though. If I can’t have one $10/mo subscription… what’s the point of being a millionaire in some hypothetical future if I spend my prime years depraved and depressed?

That’s been a point of discussion in financial independence circles. You can rearrange your whole life so you’re saving 60% of your income, and some people have. Are they happy? Often not, and some of them have backed off when they realized they shouldn’t give up so much happiness now for the prospect of being happy later.

Sure, but at the median income in the US, you don’t need to be depraved or depressed. At least not for monetary reasons. I’m not saying you need have to cut all subscriptions. A lot of people have much more than one reoccurring charges or spending habits that could either be reduced or cut completely with little to no effect on QoL.

All true. But this is on a linear scale. Worth noting that wealth aggregates exponentially. Which is to say, getting from $0 to $1M is far more difficult than getting from $1M to $2M, thanks to our financial system’s method of compounding returns on investment over time.

The cost of one’s basic living needs heavily weigh down one’s ability to aggregate wealth when one is poor. But basic living costs are trivial to someone who is rich. Same with one’s ability to leverage borrowing power. It is very easy to become a billionaire if you can get ahold of a billion dollars in credit. And much of the real value of modern billionaires is measured in their credit-worthiness rather than their real liquidity. Elon Musk is a great example - a guy whose billionaire status is almost entirely bound up in how his car company and his social media company and his aerospace company are valued.

The speculative valuation of these firms is driven by the availability of lending. That’s why Tesla, a company that produces less than 1M vehicles/year is valued at twice the market cap of Toyota, a company that produces over 10M vehicles/year.

TL;DR; The millionaire/billionaire distinction isn’t linear. It is exponential and heavily speculative. Real utility value isn’t what gets measured. And so the distinction between a millionaire and a billionaire is far more about one’s ability to borrow money than one’s actual accumulated assets.

That’s an interesting way to think about it that had never occurred to me. Thanks.

And much of the real value of modern billionaires is measured in their credit-worthiness rather than their real liquidity. Elon Musk is a great example - a guy whose billionaire status is almost entirely bound up in how his car company and his social media company and his aerospace company are valued.

This describes most figures with a net worth over a few million - most of the time most of that wealth is in the form of non-liquid assets like owning pieces of companies or real estate. Much of their wealth is in their ability to borrow against speculative income from those sources.

I’m currently a millionaire because at the time, it was cheaper to buy then it is to rent. There was a first-time homebuyer bonus also and we only needed 3.5% down. We figured if we just broke even when we wanted to move, it would have been worth it. This was back in 2009. Then, waited 10 years and I can’t afford that condo that I bought with my income today.

I’m in a weird situation where:

- my house is double the value

- my equity has tripled or quadrupled

- yet my mortgage is bigger than the original purchase

- and the payment is half, as a percentage of my monthly income.

What kind of mortgage did you get? Is it on a 15 year arm or something?

2.3% fixed. I refinanced just before rates went up a few years ago

Man, crazy deal. It’s pretty much free money. It’s below inflation. Gotta keep that until you pay it off.

It’s pretty useful to do little savings like that though

Until you hit your first billion dollars, and then its trivial.

Well that’s certainly something to look forward to. Right now I’m just looking to save money for a better bed lol.

I feel this so much. My mattress has huge dents in it from weight & time. It’s memory foam but it only remembers dents now.

Becoming a millionaire is surprisingly easy if you follow these steps:

- Make coffee at home

- Cut back on Avo toast

- Be born a millionaire

If becoming a millionaire/billionaire is an actual goal for some people, no wonder this planet is fucked.

You pretty much need to be a millionaire if you want to be a home owner in a lot of places, although the problem is the inflated market.

Yeah, saying millionaire/billionaire as a category is gibberish. You have to be a millionaire if you want to do something crazy, like, I dunno, retire comfortably when you’re 65. You have to be a billionaire, well, never. Nobody needs to be a billionaire.

I’d like to be a millionaire, but that is an method to achieve another goal, not the goal itself.

I’d like to vertically farm algae on an industrial scale as an atmospheric carbon sink, and additionally see if there is any way to do so profitably while remaining carbon negative. 1 million dollars would probably be enough to construct a small facility and hire the staff and experts I would need to figure this out.

“Millionare/billionaire” as an identity should be an insult.

Anybody with an industrial mindset will bare minimum want to take any large amount of liquid asset and turn it into production. Build and improve factories, fund research, improve living conditions near your operations. Having money acruing interest can be part of that, but should not be your primary revenue stream.

Don’t wait to be a millionaire for that. See if you can find people who are also interested in it and build it as a co-op.

That said, I think you’ll run into problems with the square-cube problem. Volume of algae goes up by a cube factor, but they need light. That light has to be fed by energy that has to be gathered by taking up surface area of the Earth, like solar and wind, but that only goes up by a square factor. Hydro and nuclear sources are maybes here, but you’d have to scale way, way up to make that viable (many billions of dollars, not millions). Presumably, you don’t want to use energy from carbon-based sources just to suck that carbon back into algae.

I mean…business school exists.

Being a millionaire is a good goal if you want to be able to retire before you’re ancient. You need something like that just to live. No one needs to be a billionaire - the difference between a million dollars and a billion dollars is staggering.

Nobody wants to enter professions that require hard work because it pays pittance relative to popular entertainers, and traditional milestone purchases have become moving targets, so why not gamble it all?

Or being born into the family of a former Plantation Owner.

Generational wealth for us, nothing for the descendants of the people we used to own as property.

Right, but if you stop buying coffee every single day, even a cheap cup, that’s like $30-100 saved per month or $1200 or more in a year. That’s not nothing. That dread you get around the holidays of “will I have enough money to buy presents?”, well, now you can buy presents.

People seriously buy coffees every day? I like coffee, and I have enough disposable income to buy coffees often outside, but honestly never do it. Maybe it’s because I grew up poor but it seems an awfully wastefuk habit. I have coffee at home before work, or in the office (free).

wastefuk

If that was a typo, let it retroactively not be. Wastefuk is a great word, especially how you used it, which I read as adjectivizing ‘the habits of a Wastefuk.’

Don’t be a wastefuk, everyone. Make your coffee at home. But not with k cups.

Wastefuk, who let you out of your pokeball???

It’s extremely wasteful. In college I was spending a lot on coffee, but as an adult who actually has to worry about budgeting, it’s a poverty trap. North America runs on convenience items.

I don’t think it’s because you grew up poor. It’s because why would you buy coffee everyday?

I buy coffee almost everytime I’m at an airport or a train station, but that’s like… once every two months? If I would commute by train, I wouldn’t buy coffee everytime I’m at the train station, I would just wait until I’m in the office to grab a cup.

But I did buy a coffee daily, when I was in university. There was no way to get a coffee besides buying one, so I bought one. So I think thats the main thing about buying daily, necessity. Some companies only have paid machines, so you buy a coffee daily when at work. In school or university you don’t have a coffee machine available, so you buy one daily.

In uni we have 30 cent coffee machines and it was the only way to keep my brain going.

I love going out for coffee, especially now that my favorite coffee place started using mugs instead of cardboard plastic coated cups.

I get to mix a latte machiato with a double espresso, those mugs are huge.

Disclaimer: it’s my workplace and the coffee is free.

For a sense of proportion, in a housing market where house prices go up 5% a year, a $200k house (which nowadays is cheap), goes up $10k in a year.

So that “trick” barelly slows down the rate at which you’re getting further behind on your chance of getting your own place to live, even a cheap on in a moderatelly growing market.

Such barebones saving only works if you’re really really close to being able to afford a house, otherwise you’re just making your life a bit more miserable for no actual gain as the extra savings are just going to be sucked out in paying for just about anything where realestate costs have an impact (so, not just somthing quite directly affected like your rent, but also pretty much all products and services bought from stores and companies who rent their space).

I don’t drink coffee, I don’t like avocado, and I don’t buy random junk. What gives?

Have you tried supplementing your income with fraud?

Actually no, I haven’t, but I might give it a shot though. Any tips?

Ask your parents for a small loan of a million dollars

You could try having a trust fund…